Why Modern Insurers Should Partner with UEM Providers

Sep 03, 2025 | Upasna Kesarwani

Introduction: The Shift in Enterprise Risk

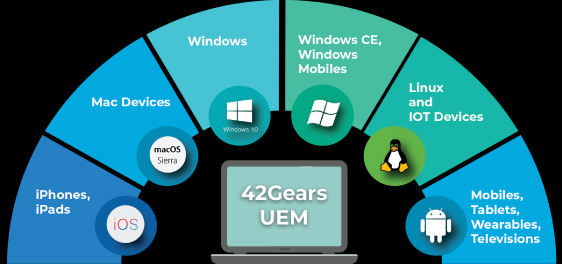

Companies rely heavily on mobile devices, rugged hardware, IoT systems, and smart endpoints to run daily operations. For insurers, this presents a growing opportunity to offer coverage for physical damage, theft, or breakdowns of these devices. But there’s a catch: hardware isn’t the only thing at risk.

Cyberattacks, data breaches, and unauthorized access have become just as critical as physical damage—if not more. This is where insurers can unlock powerful value by partnering with Unified Endpoint Management (UEM) providers.

Why This Partnership Makes Strategic Sense

1. Extend Protection Beyond Physical Assets

While traditional insurance covers loss, damage, and malfunction, it often doesn’t address risks like data theft, ransomware attacks, or compliance violations. UEM tools help mitigate these risks by securing endpoints, enforcing policies, and managing software integrity.

Bundled Benefit: By offering UEM-powered cybersecurity as an add-on or bundled feature, insurers can deliver comprehensive protection—both physical and digital.

2. Drive Cross-Selling of Security and Insurance

Security is no longer an IT-only concern—businesses want peace of mind. Insurers can position themselves as more than claim processors by offering value-added services that reduce risk in the first place.

How It Works:

- Insurers offer a bundled package: device insurance + UEM-powered security.

- Businesses see value in reduced risk and streamlined operations.

- This opens up cross-sell and upsell opportunities for cyber protection policies.

3. Minimize Claims through Proactive Risk Management

With UEM software, devices can be remotely locked, wiped, or tracked in real time. If a company tablet or laptop goes missing, IT teams can instantly locate it using GPS tracking and take action—such as sending alerts or disabling access—before any data is compromised.

This not only prevents potential breaches but also helps businesses recover lost or misplaced devices without having to file a claim.

Insurer Advantage:

- Fewer device loss claims thanks to real-time location tracking.

- Lower claim frequency and improved loss ratios.

- Enhanced customer satisfaction due to reduced downtime and faster device recovery.

4. Offer Premium Discounts for Secured Endpoints

Just like safe drivers get discounted auto premiums, businesses with managed and secured devices could benefit from reduced insurance rates.

Incentive Model:

- Encourage customers to adopt UEM solutions.

- Reward security maturity with better premiums.

- Build loyalty and long-term retention.

5. Improve Underwriting with Endpoint Insights

UEM platforms provide granular visibility into device health, usage, location, compliance status, and potential threats. These insights can be invaluable during underwriting.

Impact:

- More accurate risk profiling.

- Better differentiation between high-risk and low-risk clients.

- Dynamic policy adjustments based on real-time data.

Real-World Use Case

A logistics company with 1,000 rugged devices insures its fleet through a traditional insurer. By adding a UEM-powered security layer, the insurer enables the client to:

- Track devices in real-time.

- Lock/wipe data in case of theft.

- Ensure only approved apps are used.

- Monitor device health to reduce breakdowns.

The result? Fewer claims, enhanced security, and a new revenue stream from security add-ons.

Conclusion: Insurance + Security = Future-Proof Protection

Modern enterprise risk is no longer just physical—it’s digital, distributed, and dynamic. Insurers serving B2B clients must adapt by offering holistic coverage. Partnering with UEM providers allows insurers to go beyond the claim, to actively help clients reduce risk, improve security posture, and ultimately, future-proof their businesses.

This isn’t just a service upgrade—it’s a strategic evolution.

Secure your insurance offerings,

reduce risk, and increase revenue.

Partner with a UEM provider.

Subscribe for our free newsletter