MDM for Banking, Financial Services, and Insurance (BFSIs)

Revolutionize Your Financial Operations with Enterprise-Grade Mobile Device Management

Secure, Streamline, and Scale with 42Gears

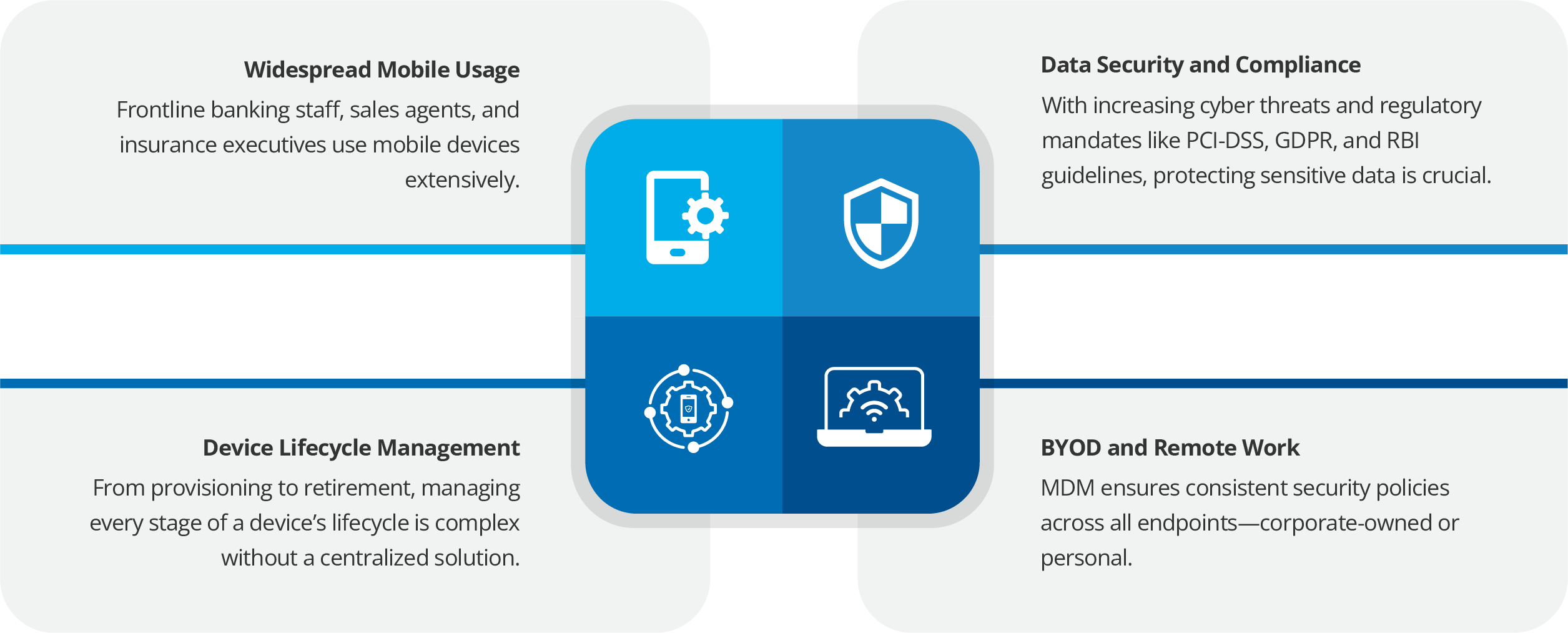

The BFSI (Banking, Financial Services, and Insurance) industry is one of the most highly regulated and security-sensitive sectors in the world. With increasing reliance on mobile devices such as tablets, smartphones, laptops, and terminals for everything from customer onboarding to digital transactions and remote employee access, managing and securing these devices becomes critical.

Mobile Device Management (MDM) is no longer optional for banks and financial institutions—it’s a necessity. In light of breaches like the SRP Federal Credit Union incident, where over 240,000 members’ sensitive data was exposed, a robust mobile device management solution is critical to safeguard data, ensure compliance, and protect against cyber threats.

Why Do Banks and Financial Institutions Need an MDM Solution?

Why Choose 42Gears for MDM in BFSI?

42Gears offers a proven MDM solution for BFSI institutions tailored to meet industry-specific challenges. With a focus on scalability, compliance, and zero-trust security, 42Gears helps banks and financial service providers operate securely and efficiently.

Trusted by BFSI leaders worldwide, our platform delivers:

Bank-Grade Security

Protect sensitive financial data with military-grade encryption, remote wipe capabilities, and granular access controls across all endpoints.

Regulatory Compliance

Stay ahead of PCI DSS, GDPR, SOC 2, and other financial regulations with comprehensive compliance monitoring and reporting.

Operational Efficiency

Streamline device deployment, updates, and management across branches, ATMs, and customer-facing technologies.

Multi-Device Support

Manage every device in your ecosystem—from employee tablets to customer-facing kiosks and IoT devices.

Top Features of EMM

Critical BFSI Requirements Fulfilled by 42Gears Solutions

Bank-Ready Security. Enterprise-Ready Control.

Enterprise-Grade Security

- Enforce strong passcodes and encryption

- Remote data wipe for lost/stolen devices

- Role-based access control

Stay Compliant. Stay Confident.

Compliance & Auditing

- Real-time tracking and device usage reports

- Automated compliance alerts

- Support for financial regulations and audit trails

Zero Downtime. Maximum Control.

Remote Configuration & Troubleshooting

- Over-the-air provisioning and updates

- Remote support to minimize downtime

Track, Trace, and Trust Your Devices.

Geofencing & Location Tracking

- Ensure devices are used only in authorized locations

- Alert for unauthorized movement or access

Seamless App Control. Secure Content Flow.

App and Content Management

- Push critical banking or insurance apps securely

- Allowed/Disallowed apps based on roles

Tailored Solutions for Financial Services

- Secure management of teller tablets and customer service devices

- Simplified deployment of banking apps and services

- Kiosk mode for customer-facing interfaces

- Streamlined ATM management and security

- BYOD security for financial advisors

- Secure document sharing and collaboration

- Compliance-ready audit trails

- Instant remote wipe for lost devices

- Field agent device management

- Secure claims processing on mobile devices

- Content filtering and application control

- Location tracking for enhanced productivity

FAQs

What is Mobile Device Management (MDM) for BFSIs?

Why is MDM important for banks and financial services?

How does MDM improve data security for BFSIs?

Can MDM help with compliance and regulatory requirements?

How does MDM support mobile app management in BFSIs?

Can MDM be integrated with existing banking infrastructure?

What are the key features of MDM for BFSIs?

How does MDM ensure employee productivity while maintaining security?

How can MDM prevent unauthorized access to financial data on mobile devices?

What should BFSIs look for when choosing an MDM solution?

Is MDM for BFSIs scalable for large institutions?

How can MDM help in reducing operational costs for BFSIs?

Join the Future of Secure Financial Mobility

In today’s fast-paced financial landscape, MDM for banks and financial institutions isn’t just about device control—it’s about enabling secure, efficient, and compliant operations. 42Gears helps BFSI organizations achieve all of this with ease.

Let’s Secure Your Digital Finance Journey Today.