How is Enterprise Mobility Management (EMM) Impacting Banking, Financial Services and Insurance Companies?

Author: 42Gears Team

In the wake of digitization, Banking, Financial Services and Insurance (BFSI) industry is undergoing a massive transformation. Emerging technologies have enabled these organizations to redefine their strategies and deliver business goals effectively. Mobility and digitization have become the key enablers for BFSI industry to reduce operational costs, process faster transactions, rollout personalized offers and products and attract new customers.

However, the growth of BFSI industry is hindered by some common concerns such as IT asset management, automation, efficiency, data security and others. This paper attempts to assess the impact of digitization on the BFSI industry, common challenges faced by BFSI during the digital transformation and EMM features which can support the BFSI vertical to deliver engaging and fulfilling services.

Introduction

According to a 2017 report by Deloitte, “Digitization will dominate growth initiatives in the payments space”. From SMS based support service, mobile banking to kiosk mode tab banking, the journey of digitization in BFSI industry has been extensive. The financial technology movement is disrupting the traditional banking system, in-app and mobile wallets have become ubiquitous payment tools, biometrics have become integral part of digital payment systems, particularly mobile, to enhance security. This evolution is helping BFSI enterprises to mitigate the gap between services and customers. Digitization is also enabling these companies to get insights on their consumer behavior, preferences, choices, aspirations, requirements and needs.

The impact of digitization in the BFSI vertical necessitates equipping the workforce with right tools. Mobile devices, as digital tools, can empower BFSI employees with on-hand access to data and enable them provide an optimized service. However, large deployments of mobile devices requires the availability of a platform to manage mobile devices and resources, along with support and maintenance. EMM solution can help BFSI organizations to tackle all these challenges and fulfill various levels of expectations while delivering services.

Mobility Challenges in the BFSI industry

Centralized view of the devices:

BFSI industries lack a proper system which can manage the inventory of devices and track whether the devices are online or offline. They need to keep a track of all the mobile devices used in the field by the salesforce and ensure that they are not being misused by the employees. Unintended use of the devices like watching non-related videos, playing games or installing apps can lead to loss of productivity.

Launching apps and pushing app updates:

Often BFSI staff, particularly microfinance, need to visit clients in remote locations where wireless connectivity is difficult. Pushing app updates silently on devices, providing remote assistance for technologically challenged users operating from remote locations are few of major challenges for the microfinance industry.

Data security:

In any business environment, enterprises generate and deal with large amount of data. Drawing a meaningful inference from this data is quite a Herculean task. Custom and dynamic reports from analytics engines help to bring together relevant information. These reports can be presented in the form of informative visuals to depict trends and patterns.

Industry wise statistics on digitization which shows BFSI vertical is leading in the transformation.

Role of EMM in BFSI industry: EMM Features that are useful in BFSI sector

For BFSI, Enterprise Mobile Management solution supports mobile workforce, deploys customer-centric workflow at branches, and improves employee satisfaction by executing mobility initiatives like BYOD (Bring Your Own Devices). It can help the mobile workforce to access corporate data and collaborate securely while on the move, track the devices in real time, silently install or push app updates and enforce compliance policies. Cellular data expense management functionality and international roaming monitoring feature are also useful features that keep the bank's mobile data costs under control

Some of the EMM features that are useful in BSI Sector are:

- Bulk Device Enrollment

An EMM solution helps the IT admin to enroll devices in bulk within seconds through QR code scanning. It easily integrates with the existing workflow, streamlines the onboarding of new users as the business grows and can integrate well with the existing workflow.

- Device Provisioning

It aids the BFSI organizations to remotely configure mobile devices and provide access to enterprise apps and corporate data resources while still ensuring compliance. BFSI apps include tools for financial apps such as wealth management, mortgages and insurance. Banking employees need to access to financial apps through the tablets outside the banks in order to connect to the customers at their ease and EMM solutions can make the provisioning of these devices easy and seamless.

Single-Sign-On (SSO) feature of EMM helps to secure financial apps and customer data, by allowing authenticated users to access corporate data on trusted devices and enterprise applications. Users can login to multiple applications without having a new set of credentials.

- Location Tracking and Device Health Monitoring

It helps to manage BFSI mobile architecture, where the manager or the admin can ensure that the devices handed over to wealth managers, lenders, and agents are operated judiciously within their allocated regions. As BFSI advisors and collection agents are constantly on the move to visit prospects, perform signups, upload customer’s data, etc., it becomes crucial for them to maintain adequate power and connectivity on their devices. The geolocation feature of EMM uses GPS capabilities to search and locate devices which are missing. It has also been useful to reduce the costs associated with employee-owned iOS devices. The ability to locate devices also minimizes the need for wiping devices, replacing devices, and re-configuring devices.

The Device health monitoring feature keeps the admin alerted on keeping devices optimal for business use and take precautionary steps.

- Data Usage Monitoring while roaming

This EMM feature can help to keep the bank’s mobile data costs under control. IT admins can remotely set mobile data thresholds and corresponding actions like triggering an alert mail or complete blocking of mobile data. When the bank employees cross the data threshold while travelling , both the organization and the employees are notified warning them to take necessary action.

- Device Security

This is one of the most prominent features of this sector. The security compliance and ordinance obligations are very daunting for BFSI firms; hence, the enterprises need to remain highly cautious about information security and integrity. Undoubtedly, BFSI workforce have to carry sensitive customer financial, account and identification data on their handhelds. The data remains vulnerable to misuse and threats. For instance, a lost or stolen handheld device will be a great threat to customer data, and may cause irreversible damage to an enterprise’s reputation for mishandling it. An EMM solution will allow the admin to remotely wipe or lock the devices in case of lost or theft. It can detect if any device has been jailbroken and restrict employees from installing unapproved apps. Thus, an EMM solution not only increases the overall security of the customer data but the devices as well.

- Kiosk Lockdown and Secure Browser Features

Digital banking kiosks have been employed in banks for the past many years. Self-service kiosks are configured to use the latest biometric security devices to verify customer identity and provide easy access for existing customers. Financial kiosks are secure and convenient tools which provide 24/7 access to users. However, these systems can have complex connectivity, security, compliance, service and usability issues that require expertise and experience with all facets of a company’s operation.

With Kiosk Lockdown and single app mode offered by EMM, the access for advisors and field executives is restricted to only approved enterprise portals and websites so that they can demonstrate products and capture customer data, improving the overall workforce productivity. Employees are not able to access any other application or change device settings without the permission of the admin. It secures data and prevents data loss and data theft.

- Digital Signage Technology

Digital Signage technology is one of the integral features of EMM and is used by numerous banking and finance institutions today. It serves as a marketing tool for displaying ads or company information, thus providing a great opportunity to market to both current and potential customers. Digital signage allows enterprises to educate customers with content like product information, news, advertisements, or any other info the business may want to deliver to the customers. It is one of the primary methodology to improve awareness and branding in BFSI branches.

An EMM regulated kiosk at bank branches can perform multiple functions secured by Digital Signage, Kiosk Lockdown and Secure Browser technology that improve customer experience. These are the primary EMM features used in a kiosk deployment that help financial institutions attain a secure browsing environment and prevent the kiosk mode devices from unauthorized access. They regulate access to approved applications and allow admin to loop video/media content securely, thus preventing users from tampering with the device or change its settings.

- Geofencing Technology

BFSI firms maintain a crucial relationship with their agents and merchants. These individuals are consistent source of revenue for BFSI firms. Usually organizations provide them tablets with enterprise apps to perform business operations. By using geofencing technology, enterprises can trigger notifications regarding product updates and support their sales. The integration of geofencing with EMM improves communication with their agents and merchants, and helps them to improve the overall productivity of the organization.

Innovative EMM Use Cases

With EMM flourishing in BFSI industry, numerous use cases can be witnessed. Many studies carried out in the banking industry from the third world countries have found that M-banking is the best for an improved banking service in developing countries (Lyman et al, 2008; Guriting and Ndubisi 2006; Cheney 2008).

- Insurance

A Nashville-based personal auto insurance selling company deployed insurance kiosks called “Direct on the Spot” (DOTS) in multiple retail stores. It allows people to quote, buy and print a car insurance policy in less than few minutes. The customers can also scan their license at the self-service kiosk that generates a quote and the option to proceed with the buying process.

- Microfinance

EMM solution enables the microfinance institutes to keep infrastructure cost low and yet deliver enhanced customer experience. Infrastructure and connectivity is a concern for microfinance organizations. Keeping tracking of devices while they are being used in the field, distraction of field staff due to personal usage of devices, customer data security and launching app, enforcing compliance policies and pushing app updates while the device is in rural locations are some of the main challenges for the microfinance industry.

An EMM solution counters these challenges and helps them to manage the complete lifecycle of mobile devices, ranging from device enrollment to wiping corporate information.

- Wearables in BFSI

Wearables integrated with EMM support is the next wave in the BFSI sector. Wearables can support BFSI business by strengthening communication, enhancing workforce mobility and productivity.

The BFSI sector has started offering wearables to their customers to strengthen their general process. For example, Barclays in UK provides smart wristbands to its customers to pay for their daily commodities in a fast and efficient way without using cards or cash.

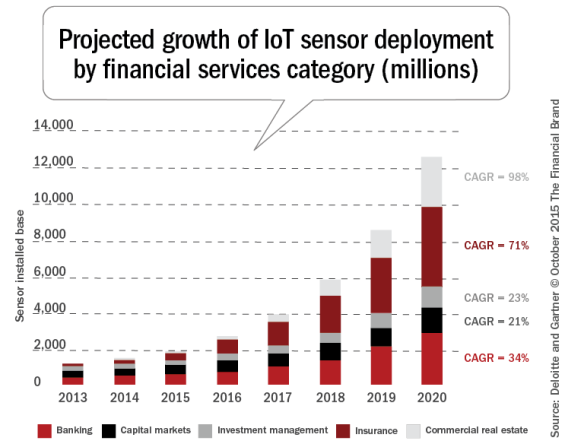

Integration of IoT sensors with EMM can play remarkable role in strengthening the enterprise mobility in the upcoming years. Let us have a quick look at the statistics below about IoT penetration in BFSI industry.

Conclusion

EMM solutions have gained momentum and popularity in the BFSI sector. But many BFSI organizations are yet to adopt and deliver business objectives by leveraging the true power of mobility. A well-planned EMM strategy in all facets of workforce management and technology integration, makes a BFSI organization well-equipped to address dynamic market pressures in the rapidly evolving industry. It offers an opportunity to reduce overall cost, improve customer experience, productivity, ease the IT burden of deployment and set organizations aside from the competition.

42Gears offers industry ready agile EMM solutions for a wide range of business verticals. The BFSI industry specific customized features in the EMM solution helps them to achieve their mobility goals and work seamlessly across all OS platforms including Android, iOS, MacOS, Windows, Linux and Chrome.